As with all things political in an election, there are shades of the truth. Nearly half do not pay any income tax. They pay lots of other taxes, both directly and indirectly.

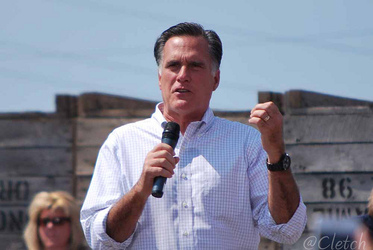

Democrats right now are all over Mitt Romney like the pack of dogs gnawing on the Christmas turkey in that holiday favorite, “A Christmas Story.” That’s politics. It

| | was rather clumsy of Romney to identify the 47 percent of people who pay no income tax as supporters of Barack Obama who believe they are victims entitled to something from the government. That isn’t true. There are disabled veterans, senior citizens and, certainly, poor people on that list. But amid the political dog pile, no one seems to be paying attention to the real issue here. Romney touched on it, but even he isn’t grasping hold. It is that the U.S. tax code is in drastic need of revision. To say the code has reached Biblical proportions is to exaggerate the Bible. Experts disagree on how many words it contains. The Tax Foundation puts it at about 10 million. The Bible has only 774,746. And those 10 million words aren’t nearly as uplifting or full of hope. I would venture to say no one single person understands the entire code. Millions have to hire someone to prepare their tax forms each year. Is that the best way to fund a treasury? Back to those 47 percent (The Tax Policy Center puts it at 46 percent). About half of them are below the poverty line. A lot of the rest take advantage of tax credits and various deductions, and some of them are wealthy people who earn much of their money from investments or capital gains. It is legitimate to question whether even the poor should pay a nominal amount of income tax, just so they can have a legitimate stake in the issues surrounding the tax and what it funds. The problem with that is the poor do already pay plenty in other taxes. Why does their exemption from one tax alone disqualify them from understanding the burdens of taxation? No, what Romney and Obama both ought to address is how inefficient and unfair the income tax has become and to propose plans for its revision. The odd thing is that Romney chose a running mate with a record of addressing tough budget problems with radical proposals. Questions about income tax reform and fairness should be right in his wheelhouse. |

RSS Feed

RSS Feed