Now, Utah Sen. Mike Lee is pushing a plan to add a federal child income tax credit of $2,500 per child on top of the current $1,000. Lee says this is in order to reward parents who are bearing the load of raising the next generation of adults, who, once they are grown, educated and contributing to society, will more than amply repay any credits their parents received from Washington.

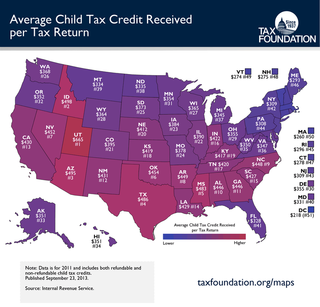

| | There is truth to that. One of the reasons Utah grants state income tax exemptions for children is to recognize the contribution those parents make to the state’s future, and to officially promote the raising of children as something of value. The way Lee puts it, the taxes parents pay for senior entitlement programs is a “parent tax penalty.” Parents have to pay taxes plus the costs of raising new taxpayers. Still you can’t get around the fact that increasing the federal child tax credit will increase that 47 percent who contribute nothing in terms of income tax. In a Tax Foundation blog this week, William McBride and Richard Borean write, “The child tax credit knocks millions of households off the federal income tax rolls, and, because of the refundable portion, is a major contributor to the situation where about 40 percent of households have a negative federal income tax rate.” (Read the blog here.) They also map out a state-by-state accounting of the amount of child credits received per tax return filed. That is the map accompanying this blog. Utah finishes first. It’s not even a contest. Utahns receive $665 in credits per tax filer. Second place Idaho receives $498. Lee’s tax credit may be good public policy, but it’s great politics for the home state. There are many reasons why people might not owe a dime in federal income tax. Some fit the stereotype of poor people who receive help from entitlement programs, but many others are young and don’t yet earn enough, or are senior citizens, or have a lot of children and take advantage of tax credits conservatives support. Some are wealthy and have found loopholes. Many of the poor have jobs and so contribute payroll taxes for Social Security. This Washington Post piece from a year ago outlines some of the myths surrounding the 47 percent. There may be good reasons for wanting to add an even larger child tax credit to the code. But conservatives can’t keep complaining about how many people don’t pay taxes while at the same time advocating moves that would add to that amount. What is needed is complete tax reform. Anything short of that simply complicates things even more |

RSS Feed

RSS Feed