| | Any time Washington issues a decree, you can bet complications, conflicts and costs will follow. The latest example involves the IRS announcement last week that legally married gay couples may file joint income tax returns, even if they currently live in states where gay marriage is illegal. Income tax preparers and attorneys, rejoice. If America didn’t have 50 separate states with separate constitutions and laws, such an announcement might be straightforward. |

Of course, you can’t entirely blame the IRS. The U.S. Supreme Court set the stage for tax confusion when it struck down the Defense of Marriage Act earlier this year, but left standing a part that lets states define marriage.

I’m not suggesting they should have struck that part down, as well. It’s clear, however, that next April 15 could be interesting in much of the land.

Between now and the end of the year, many states in which gay marriage remains illegal face a choice. Either find a way to deal with this as smoothly as possible, or face a situation in which gay couples who have obtained marriage licenses in other states are forced to file separate state income tax forms requiring them to use figures from their joint federal income tax forms.

It won’t work.

You simply can’t file jointly on the federal level and separately in your home state if you have to reference one form on the other.

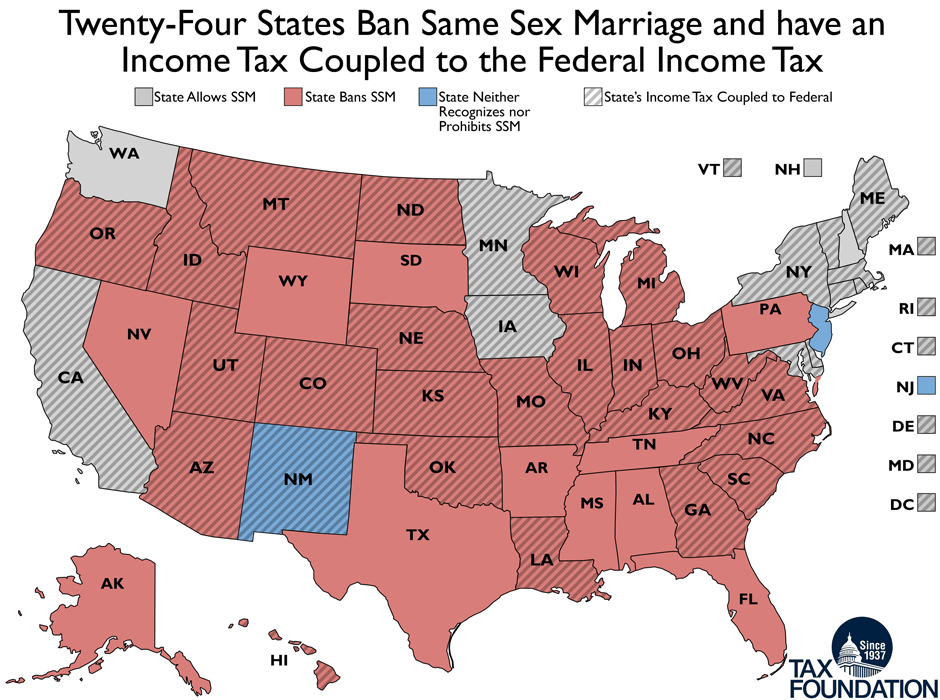

The Tax Foundation, a Washington research institution, says 24 states currently fall into the category of not allowing gay marriage and requiring tax filers to reference federal returns on their state tax forms. Some other states do not require such a thing, and others still have no income tax. The graphic above, by the Tax Foundation, shows how this breaks out.

| | Wisconsin already has tried to deal with this by coming up with a separate tax form, known as Schedule S. |

But the Milwaukee Journal-Sentinel recently interviewed an accountant and attorney who said people are bound to challenge this and other inequities in court. Whether they prevail is another matter, considering Wisconsin’s constitution, like those in many other states, prohibits gay marriage, which makes it impossible for the state to recognize it in its tax laws.

But such cases may find their way up to the Supreme Court, where a majority appears ready to declare a gay marriage right.

The Tax Foundation lauds Wisconsin’s Schedule S and suggests the other 23 states in this boat could do the same or provide a scheme that allows such couples to evenly split their federal returns down the middle. States that allow domestic partnerships or civil unions could create a separate joint filing status for those couples, it says.

Meanwhile, the Chicago Tribune quoted Jenner & Block tax attorney Gail Morse as saying Congress could clarify the issue somewhat with a “Respect for Marriage Act,” that makes the federal tax rights of gay couples clear. Otherwise, a two-tiered system will remain in much of the land.

In related news, pigs still cannot fly. Congress isn’t about to pass such a thing.

It’s unclear how many couples will be affected by this problem. But the side story here is that anyone hoping for state federal tax laws to become simpler and less expensive to comply with just found another reason for pessimism.

RSS Feed

RSS Feed